Comparison of rental income between equipment of different years of manufacture

The rent of machinery can allow yields higher than 33% per year, however, this figure will not be applicable in all cases.

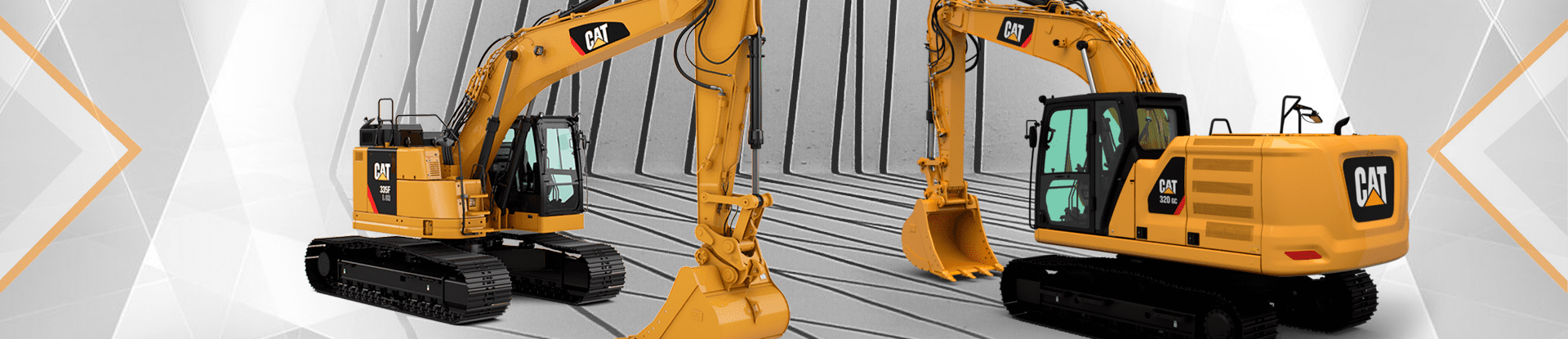

Two 20-ton excavators of different series and years of manufacture but of the same brand are analyzed to contrast the income received by each of them after putting them up for rent to individuals.

The data mentioned in this publication were provided to Gotoyard by a company dedicated to the purchase and rental of heavy equipment.

The first vehicle is an excavator with the following data:

| Marca | Caterpillar |

|---|---|

| Brand: Caterpillar | Model 320C |

| Manufacturing year 2012 | 2004 |

| Vehicle cost | Vehicle cost 75431.93 USD |

| Cost for repairs | 31412.21 USD |

| Months rented since acquisition 11.40 | 11.40 |

The second vehicle is the following:

| Marca | Caterpillar |

|---|---|

| Brand: Caterpillar | 320D |

| Manufacturing year 2012 | 2012 |

| Vehicle cost | 1,696,792.00 MXN (84,953.32 USD) |

| Months since acquisition 25.89 | 25.89 |

| The monthly amount for the rental of the equipment. | 60,000.00 MXN (3004.02 USD) |

| Ingresos totales generales | 1,338,500.00 MXN |

|---|---|

| Maintenance and repair costs | 132,176.00 MXN (6,617.66 USD) |

| Global profit | 1,206,324.00 MXN ( 60,397.05 USD) |

| Vehicle cost | 1,696,792.00 MXN (84,953.32 USD) |

| The total return on investment 71.09% | 71.09% |

| Net monthly profit | 46,597.00 MXN (2,332.97 USD) |

In the first 320C equipment, high investment is made to carry out repairs because it came from a malicious supplier, this led to long periods of inactivity while the excavator is repaired for rentals.

The second equipment. 320D is a model of relatively recent manufacture, with 100% functionality and in which no significant investment was required for it to be put up for rent.

The Model 320C excavator received fewer rents because it spent considerable time on repairs.

With the data obtained for the 320C excavator is estimated that 36.41 months must elapse to achieve the return on investment, and according to the Mexican machinery market is possible to resell the equipment in an estimated 89,964.00 USD if it’s necessary, due to the integrity of the vehicle, acceptance of the manufacturer brand and model.

On the other hand, the 320D equipment remained leased 86.1% of the time from its entry into the vehicle fleet, obtaining a 71.09% return on its investment in just 25 months.

The period to recover the investment once the 320C rental equipment has been restored will be 35.66 months, of which 11.40 went into work hours. At the end of the period, a resale may be made for around 57,477.00 USD considering the devaluation.

In other scenarios, such as the resale of the 320C excavator in unusable condition, that is, as it was acquired, the equipment would have reached a value of fewer than 27,489.00 USD, generating losses of around 49980.00 USD to the company.

The decision to rehabilitate damaged equipment for a later rental is based on the current condition of the machine itself, its total repair costs, year of manufacture, estimated resale price after depreciation, and other data such as the period for the return on investment.

On the other hand, the rental of equipment that is in long periods of inactivity and is 100% functional provides a constant cash income for the owner and can be used as a strategy for the remodeling of inventory in the medium term or constant lucrative activity.